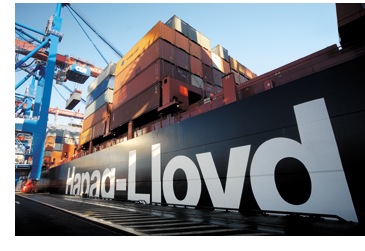

Hapag-Lloyd increases revenue and profits in the third quarter

13 Nov 2012

After-tax earnings of EUR 45.6 million / Positive operating result of EUR 86.6 million / Average freight rate and revenue substantially higher than the same period last year

After-tax earnings of EUR 45.6 million / Positive operating result of EUR 86.6 million / Average freight rate and revenue substantially higher than the same period last year

Hapag-Lloyd was able to increase freight rates, revenue and results in the third quarter, although the market environment remains challenging. The average freight rate rose year on year by 8% to USD 1,647/TEU. The rate increases initiated by Hapag-Lloyd in the first quarter and implemented in the second quarter had a tangible effect here. Transport volume in the third quarter amounted to 1.28 million TEU and revenue of EUR 1.765 billion was 15% higher than in the same period last year. EBITDA for the third quarter was EUR 164.1 million, which represents a year-on-year increase of 56%. Earnings before interest and taxes (adjusted EBIT) more than doubled to EUR 86.6 million (previous year: EUR 36.7 million). This more than made up for the operating losses incurred in the first half of the year. In the third quarter Hapag-Lloyd reported earnings after interest and taxes of EUR 45.6 million (previous year: EUR 9.6 million).

In the first nine months of the current financial year the average freight rate rose by 2.2% to USD 1,574/TEU and transport volume by 2.3% to 3.96 million TEU. Revenue climbed to EUR 5.16 billion, an increase of 14.6%. EBITDA after nine months was EUR 245 million, with adjusted EBIT of EUR 17.9 million. The Group net result came to EUR -94.1 million. The sharp rise in energy costs again weighed heavily on the result. Transport expenses, of which bunker is the largest component, were nearly EUR 750 million higher than last year in the first nine months.

Hapag-Lloyd invested EUR 692.5 million in ships and containers in the first nine months. After the delivery of two new vessels in the third quarter, Hapag-Lloyd’s order book now comprises eight ships of 13,200 TEU each, of which one is due for delivery in November. The order book and planned investment in the container fleet are already fully financed. Hapag-Lloyd holds liquidity (including undrawn credit lines) of more than EUR 650 million. The Group’s equity ratio amounts to 46.3% (as of 30.9).

The fourth quarter will be dominated by the intensifying effects of the debt crisis in the eurozone. Liquidity constraints and declining consumer demand mean that retailers and manufacturers are not filling their warehouses but instead reducing their inventories. This noticeably reduces demand for transport services in these markets, especially in southern European countries.

Despite the burden from high energy prices and the increasingly gloomy economic outlook, Hapag-Lloyd is striving to achieve a positive operating result again for the current financial year, provided that there is no fundamental escalation of the risks in the fourth quarter.

At present, Hapag-Lloyd has around 7,000 employees at 300 sites in 114 countries. The fleet consisted of 146 vessels (of which 81 are charter ships) with a total capacity of 675,000 TEU on 30 September.

Hapag-Lloyd press release